4 Ways that a POS Tablet Can Transform Customer Experience

Black Friday Shows an Uptick in EMV Usage

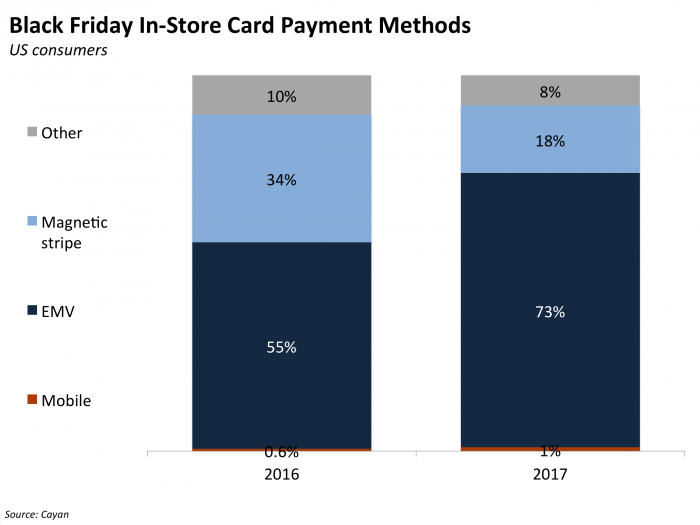

The uptick in EMV usage has increased yet again since 2015’s liability shift. Of the credit card transactions made on Black Friday this year chip-on-chip usage went up from 55% in 2016 to 73% this year, according to Cayan. Magnetic Stripe usage went down from 34% to 18%. This is a good sign as this will likely continue the decline of in-store card fraud because of the safety that chip cards provide.

The uptick in EMV usage has increased yet again since 2015’s liability shift. Of the credit card transactions made on Black Friday this year chip-on-chip usage went up from 55% in 2016 to 73% this year, according to Cayan. Magnetic Stripe usage went down from 34% to 18%. This is a good sign as this will likely continue the decline of in-store card fraud because of the safety that chip cards provide.

It’s clear that EMV is here to stay and something that should be included in any standard POS Terminals. Not having an EMV POS terminal could risk the loss of potential clients. See below for some options on EMV equipped POS terminals.

- Versatile Payment PIN Pad

- Integrated Magnetic stripe, IC card reader and Contactless reader (NFC ready)

- Ethernet or Wifi+Bluetooth Integrated

- High Performance and Security

- EMV Level 1 & Level 2, PCI 3.1 and TQM

- Plug and play, PIN and pay

- Secure and easy to install

- EMV Smart Card Reader

- Compact design

- Flexible connectivity

- Comprehensive services

- Secure card reader authenticator for Magstripe and EMV

- USB or wireless Bluetooth connectivity

- Ergonomic design simplifies card swiping

- No cable to interfere with reader grip

- Over 1000 card swipes between charge

- Triple DES encryption, DUKPT key management, Tokenization, Authentication, Dynamic Data

- Built-in lanyard attachment

- For use with iPhone, iPad, Android, or Windows devices.

For any questions or a quote on any of your POS needs contact us at Barcodes, Inc.

ID TECH and Worldnet Achieve EMV Certification Through First Data

ID TECH and Worldnet combine to provide EMV chip-card acceptance to cloud-based merchants, unattended kiosk manufacturers, retailers, and mobile merchants have received EMV certification through First Data. The certification using the GoChip EMV SDK encompasses all the ID TECH’s products that incorporate the ID TECH Common Kernel.

ID TECH and Worldnet combine to provide EMV chip-card acceptance to cloud-based merchants, unattended kiosk manufacturers, retailers, and mobile merchants have received EMV certification through First Data. The certification using the GoChip EMV SDK encompasses all the ID TECH’s products that incorporate the ID TECH Common Kernel.

GoChip supports traditional POS as well as iOS and Android operating systems for mobile and tablet POS merchants and is available for Windows Desktop, Apple OS, iOS, Android, Windows Mobile 8.1 and Java.

Don’t Let EMV Chargebacks Cut into Your Profits

With EMV in full swing in the U.S., chargebacks have been on the rise – especially for restaurateurs. Following a successful co-hosted webinar with National Restaurant Association on the basics of chargeback management and best practices last month, we discovered a second installment was in high demand.

With EMV in full swing in the U.S., chargebacks have been on the rise – especially for restaurateurs. Following a successful co-hosted webinar with National Restaurant Association on the basics of chargeback management and best practices last month, we discovered a second installment was in high demand.

The webinar took a deeper dive into the rules of EMV and chargebacks and what you can do to avoid them. If you weren’t able to join us for the presentation, we’ve summarized the high points here to help you better understand chargebacks and the liability shift.

Why EMV, Why Now?

Protecting yourself against counterfeit fraud is one of the main benefits to implement EMV because it’s virtually impossible to recreate the chip. The October 1, 2015 shift has caused some serious headaches, but the ultimate goal is to fix the payment ecosystem by heightening card security. There is, however, a glitch—if your equipment isn’t EMV-compatible, then use of a fraudulent EMV card can go undetected.

3 Reasons to Upgrade to EMV Now

With the official October 1st EMV compliance date behind us, there are still many retailers that have not made the needed changes to properly process EMV enabled cards. Almost all banks and credit card companies have issued chip-embedded cards to their customers in time for the busy holiday shopping season so it really begs the question what are the real advantages to making the EMV switch.

With the official October 1st EMV compliance date behind us, there are still many retailers that have not made the needed changes to properly process EMV enabled cards. Almost all banks and credit card companies have issued chip-embedded cards to their customers in time for the busy holiday shopping season so it really begs the question what are the real advantages to making the EMV switch.

- Fighting Fraud -Â Chip cards generate a one-time code with every transaction making it nearly impossible to create counterfeit cards for use in stores.As the EU has completed its migration to EMV acceptance, the region has seen an 80% reduction in credit card fraud while the US has witnessed a 47% increase

- Lower Chargebacks -Â Beginning October 1, 2015, new network rules mean merchants are more likely to be financially liable for fraud, lost/stolen transactions at their in-store locations without EMV compliance. In 2015 that liability in the United States is estimated to total more than $10 billion.

- Customer Peace of Mind -Â Customers are more than likely to shop at stores where they feel their information is safe. It only takes once to lose the customers trust and it is very difficult to get it back.

Two of the easiest solutions to become EMV compliant is simply upgrading your current payment terminals to EMV enabled ones like the Ingenico ISC250 and iPP350. Updating is an easy process and one of our Payment Processing specialists can help you find the right device for a hassle free update. Contact us today to get EMV compliant.

Infographic: Data Breaches – Is your Business at Risk?

The impending EMV Compliance deadline has brought more attention to Point of Sale security in general for all retailers these days. This infographic brings up the key concerns and steps you can take to keep your business and customers safe.

Automating Your Retail Store

When speaking to representatives of retail chains, it’s interesting to see how many businesses automate many different areas of the store. Some have a fully automated warehouse system while others have the most modern point of sale system. However, the most successful retail stores have the ability to track an item end-to-end from the moment it hits the dock door to the point of purchase and it leaving the store exit. Below we will walk you through a list of automated retail functions that will improve inventory, shelf replenishment, customer experience and point of sale through an easily automated barcode technology that incorporates mobile computers, barcode scanners, point of sale systems or other barcode equipment, along with our software solutions.

EMV Compliance and Payments Explained

If your business takes any kind of card payments then you probably have been coming across the term “EMV” quite a bit recently. If you haven’t, then it’s a good time to get educated given EMV will be changing the way payments are made and who will be held accountable for fraud in the US.

If your business takes any kind of card payments then you probably have been coming across the term “EMV” quite a bit recently. If you haven’t, then it’s a good time to get educated given EMV will be changing the way payments are made and who will be held accountable for fraud in the US.

EMV enabled cards are the type that have the small smart chip on them as well as the traditional magnetic stripe. Compared to  magnetic stripes, EMV cards are much more secure against fraudulent usage and copied cards.

With the October 1, 2015 EMV compliance deadline coming up, getting up to speed on how you can ensure your business isn’t going to be held accountable for fraudulent usage is a must. Barcodes, Inc has you covered with our new EMV Learning Page and the expertise to provide you will payments solutions for any budget.